After you very own leasing property, normally a smart idea to hold it on identity out-of an enthusiastic LLC, to simply help curb your liability and construct borrowing from the bank for the actual estate team. not, it may be problematic to find a keen LLC financial, especially if you will be doing it towards first time.

Here is how mortgage loans getting an LLC performs, advantages and you will cons of getting property mortgage under your LLC, and where to look to have a keen LLC mortgage.

What’s an enthusiastic LLC?

An LLC or limited-liability organization try a business construction belonging to no less than one some body otherwise organizations.

LLCs dont pay taxation towards corporate top the way one C providers do. Instead, LLCs was violation through’ organizations, which means that net payouts or losings was passed thanks to really to each LLC representative, claimed to your Agenda D of Setting 1040 , and taxed in the person’s price.

One person can create a single-affiliate LLC otherwise an enthusiastic LLC might have multiple participants, such as for example a m&a designed for the true purpose of spending during the rental home. LLCs is molded at condition height, therefore the ways a keen LLC is made will vary out-of state to say.

When you are interested in learning how to mode a keen LLC in your state, the brand new courtroom funding website Nolo enjoys build an effective fifty-County Help guide to Creating an enthusiastic LLC .

Great things about Managing Local rental Possessions that have a keen LLC

An LLC can also be curb your judge liability to only the fresh assets kept in LLC. Such, when you find yourself previously employed in a lawsuit having a renter otherwise vendor and just have a judgment against your, this new property on the line was restricted to people stored because of online installment loans Alabama the LLC. not, there are lots of exceptions to your coverage an LLC also provides, including whenever a trader commits downright scam.

For each person in the new LLC may have various other possession rates, or even other offers of your payouts and you can loss, depending on how the newest LLC doing work arrangement is created.

Income and losings inside the an enthusiastic LLC try introduced because of right to the owners, just who then spend taxation in accordance with the private taxation group they come in.

In contrast, a c agency pays taxes within corporate height when you are investors and shell out fees from the personal height.

When property is stored from the name of your LLC and you will buyers fool around with a house management organization to cope with brand new every day businesses, renters and suppliers wouldn’t know the brands of your people that in fact very own the true estate.

It is preferable to make an alternate LLC for every rental property that you individual. Also looking after your personal and you may providers property split, you can keep your private organization assets separated in one another type of.

This way, when there is a lawsuit associated with one of your attributes, one other features plus private assets could be secure.

With money spent inside the a keen LLC including makes it convenient to stop affect mix personal expenses having organization expenses, a thing that new Internal revenue service will always pick when you find yourself audited.

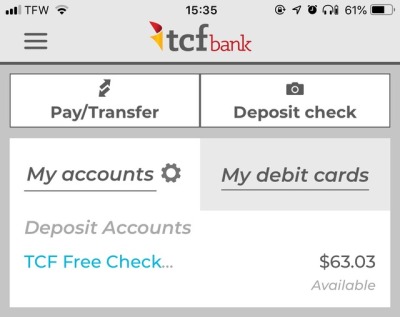

Your own LLC will have its very own lender, debit, and you can charge card profile. Then, everything you need to would are hook the individuals account along with your Stessa leasing property economic government app to speed up income and you can debts recording and you can monitor property financial abilities from your own owner dash.

Options for an enthusiastic LLC Mortgage

Lenders can make challenging for you to get good home loan using your LLC with the exact same reason you means a keen LLC protecting your personal property.