Post conclusion

- A varying interest rate means your home mortgage interest can be increase or off depending on the finest market speed, which is influenced by those things of one’s Southern area African Set-aside Financial. A fixed rates form your speed is restricted irrespective of sector activity.

- Repaired cost are better for many who want to be in a position so you’re able to budget with 100% precision, when you find yourself adjustable rates is if you are willing to gamble on the sector pushes relocating its go for.

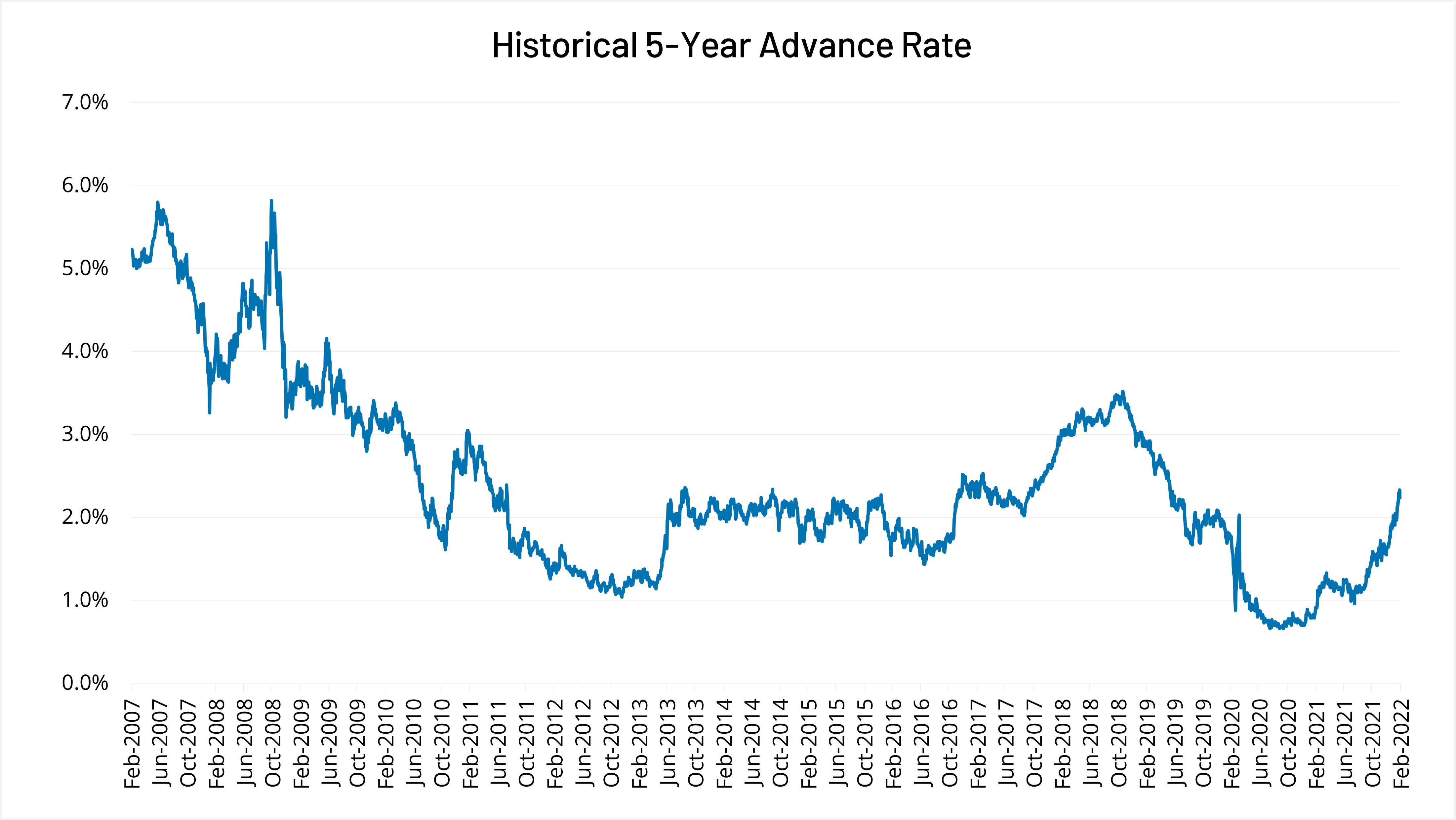

- Within the 2020, a succession out-of cuts by the Southern area African Put aside Lender lead interest rates towards reasonable top for the age, however the fresh SARB was gradually elevating rates of interest to compensate to have rising cost of living.

Can you choose to has that which you mapped away just whenever believed your finances, otherwise will you be ready to enable it to be a little place to have suspicion, about dreams one upcoming incidents will have out over the advantage? This is actually the possibilities your face when choosing ranging from an adjustable otherwise fixed interest on the home loan.

Financial interest levels explained

When you take home financing regarding the lender; and trying to repay the mortgage in payments, in addition spend an additional matter in the appeal. However need it interest rate as as little as you’ll be able to.

Your own rate of interest is actually determined by exactly how much out of an excellent risk the lending company considers you to feel. Which have a good credit record, and you can placing an enormous deposit on the possessions, commonly decrease your interest rate; when you’re a diminished credit record and lower deposit (or insufficient a deposit, like in the outcome of one’s 100% mortgage), introduces the rate of interest.

Through its a mortgage investigations service, like ooba Lenders, might help reduce your interest levels by allowing one examine sales offered by the different financial institutions.

Varying vs fixed rate of interest: Which is to your advantage?

But there is yet another factor that has an effect on the interest rates: sector forces. Once the business interest increases and you will falls, so really does your rate of interest.

- The latest SARB (Southern area African Reserve Financial) regulation the newest repo rate (repurchase price); the pace from which SARB gives to help you South African banking companies.

- This in turn determines the prime interest rate; the lowest speed of which banks will give.

- The prime rate of interest could well be more than the newest repo price, so banking companies helps make a return on their fund.

- When the SARB reduces the rate, financial institutions in turn lower the lending cost, and much more individuals are gonna use and qualify for money.

Best that you understand: Since , the top credit rate within the South Africa try ten Louisiane payday loans.5%. It had been increased because of the 0.25% in the , and you can once more by the exact same price within the .

Which boost uses a succession of great interest speed cuts in the 2020, hence produced the rate towards low it absolutely was when you look at the ages. This indicates how rates of interest can change within this a short span.

Variable against repaired rate of interest: Experts & downsides

- Pro: If the perfect interest falls in response to market forces, the eye in your financial falls on it, and also you spend less.

- Con: As well, whether your prime interest increases, thus do your repayments. The brand new changing rates of interest helps it be tough to budget properly.

Yet another basis to adopt: For each lender has the benefit of some other interest levels

In addition to business forces, the personal credit record and your put; the bank giving the house loan will have a serious part in the choosing their rate of interest. Whether it is a variable or repaired interest you happen to be immediately following, particular banking companies will provide better deals than the others, as they keeps additional credit guidelines.

A very important thing to do try have fun with a mortgage review solution, including ooba Lenders. I apply at multiple banks on your behalf, allowing you to evaluate the fresh product sales supplied by the various banking companies and choose usually the one for the reduced rates of interest.

We supply a variety of devices that improve property procedure easier. Start with all of our Thread Calculator, next play with the Thread Indication to determine what you really can afford. Finally, as you prepare, you could submit an application for a mortgage.