Khadijah Sahak, 59, lies from the family room away from their particular nicely-left townhouse within the Sterling, Virginia. The fresh Afghan information program sending out away from their particular wall surface-mounted flat-display screen tv was discussing the newest Taliban.

It leafy Arizona suburb try a long way about refugee go camping during the Pakistan in which Khadijah’s household members states it stayed after making Kabul in the 2002.

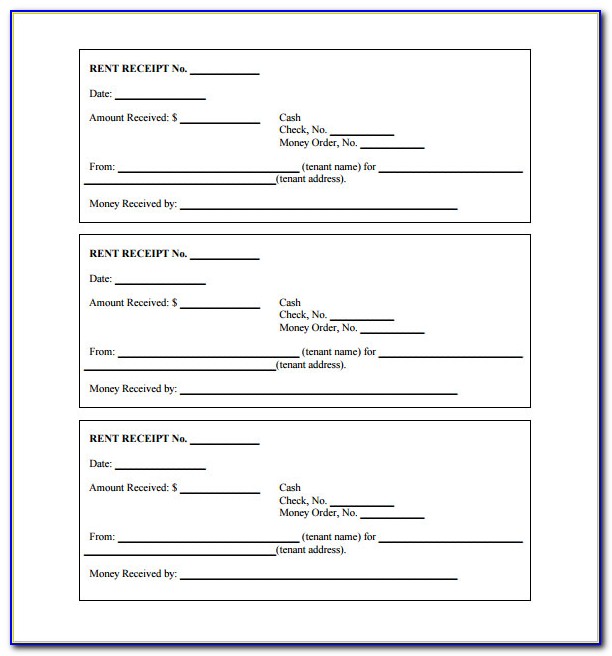

On the rent model, the newest Islamic financial purchases the home and you may rents it towards the customer within the a rent-to-very own form of arrangement

On union design, claims Sabahi, the Islamic financial and you will consumer purchase the domestic together. The customer slowly instructions the fresh new bank’s display of the property when you are and spending a charge for occupying our house.

To be done right, claims Sabahi, the bank must its find the investment, get it and transfer which control to the users. And you will a trade – as opposed to financing on the traditional sense of the phrase – is exactly what Sharia cues off on the and you may approves.

The arrangement works for devout Muslim-Western homebuyers as the Islam really does make it and come up with earnings with the a swap transaction or the marketing away from a commodity – in cases like this our home. Brand new buyers never ever end up being he could be paying interest on the currency.

In the sale model, the Islamic financial orders the house, instantaneously deal they to their consumer from the a dot-up and the consumer will pay the financial institution from inside the installments, considering Georgetown College or university rules teacher Babback Sabahi, whom lectures extensively toward Islamic financial support

We love our home a whole lot, she says into the Dari, modifying brand new white headscarf draped loosely to their face. We have been really comfy right here. The audience is at rest.

Whenever their unique grown up son, Nabi, available to assist his mothers get property, Khadijah along with her partner would not live-in a house bought which have a vintage home loan.

While the training Muslims, they feel demanding otherwise paying interest toward currency – for instance the type paid off toward home financing – was blocked by tight Islamic behavior.

Then heard about the fresh new Michigan-created Ijara Loans, certainly a handful of Islamic resource businesses in the United Claims. They will have stolen for the a niche erican homeowners through providing Sharia agreeable house to acquire deals that do not tend to be actual notice.

One to date they got extremely thrilled, once they discovered that they could still buy a great home and not lose its spiritual philosophy, Nabi claims out of his parents.

If Sahak friends ordered the brand new Sterling townhouse this present year, it registered regarding the ten,000 most other Muslim-Us citizens who have ordered property prior to now ten years having fun with Sharia-compliant financial purchases.

Recommendations Domestic, based in Reston, Virginia, ‘s the largest team in the us which supplies Sharia investment. At their roomy head office, cellular telephone providers perform phone calls of consumers primarily for the a variety of English and you can Arabic.

Spokesman Hussam Qutub claims the my review here firm enjoys processed $2.step three billion within the Islamic a home loan deals whilst introduced in 2002.

Save which do can be found is the effect one of the most of the individuals who contact us, Qutub claims. We have been in ways impacting brand new control pricing out-of Muslim-Americans when you look at the an optimistic ways.

In lieu of recharging passion towards the a financial mortgage, Islamic boat finance companies fundamentally promote homeowners a-sale, book or partnership deal towards the household.

Regarding the book design, new Islamic bank commands the home and rents they for the buyers when you look at the a rent-to-own sorts of contract

We believe we now have simply scraped this service membership here…with this specific niche market. states Qutub away from Guidance Residential. Here [are] still an abundance of customers out there of Muslim faith you to definitely never even comprehend this package is obtainable.

Sharia investment about U.S. have taken into account less than $3 million in home sales for the past 10 years – a part of the entire U.S homes erican dream about owning a home come true for lots more and exercising Muslims, like the Sahaks.

Easily can live in America and you can think that I own a home which is completely prior to my personal Islamic system, states Nabi, then i suppose the fresh new fulfillment of residing you to household create getting tenfold.

We were happy that individuals discovered an Islamic bank, Khadijah chimes for the. We didn’t including the almost every other banking companies. When we want to buy a special family it could be off an enthusiastic Islamic bank and i also tell my buddies that, too. We’re hotter like this.