Portal Mortgage is actually a keen Oklahoma-dependent bank which is a part off Gateway Very first bank. The firm even offers a number of home loan situations, plus fixed-rate mortgages, adjustable-speed mortgages, FHA loans, Va loans and USDA financing. The firm together with works for the majority of one’s U.S.

Gateway was named as one of Home loan Manager Magazine’s Top 100 Mortgage Companies on U.S. every year ranging from 2012 and 2019. Out-of 2013 to help you 2019, the organization also checked on the Inc. Magazine’s set of the latest 5000 Quickest Increasing Individual Companies.

Gateway Home loan starts finance about after the 39 claims and you may Washington, D.C.: Alabama, Arizona, Arkansas, California, Colorado, Connecticut, Delaware, Florida, Idaho, Illinois, Indiana, Iowa, Ohio, Kentucky, Louisiana, Maryland, Michigan, Minnesota, Mississippi, Missouri, Nebraska, Vegas, Nj-new jersey, The latest Mexico, Vermont, Ohio, Oklahoma, Oregon, Pennsylvania, Sc, South Dakota, Tennessee, Colorado, Utah, Virginia, Arizona, West Virginia, Wisconsin and Wyoming.

What kind of Mortgage Should i Score With Gateway Financial?

Fixed-price mortgage: This is actually the top sort of mortgage readily available. A rate is locked for the early in the loan and does not changes. Portal has the benefit of them with terms of anywhere between ten and 30 years.

Adjustable-rates financial (ARM): Which have variable-price finance, there was a fixed price to own an appartment time period, immediately after which the interest rate was periodically adjusted. Portal offers step three/six, 5/6, 7/6 and you can 10/six money. The original matter represents the duration of new fixed-rate months, while the half dozen designates that when that the prices is actually modified twice yearly.

Jumbo money: These types of really works a similar suggests just like the traditional funds, but are getting bigger amounts of money. To possess 2023, the newest limitation to have a conventional mortgage was $726,two hundred in most of the nation, though it might go doing $step one,089,3 hundred in some large-pricing sections of the nation.

FHA Funds: FHA funds appear in conjunction towards quicken loans Southwood Acres Connecticut Government Homes Administration (FHA). They want only 3% deposit and tend to be available to consumers with less-than-sterling borrowing records.

Va funds: Va loans are available into the backing of U.S. Pros Management to help you pros of one’s armed functions. There is absolutely no down-payment required and you may rates of interest are generally a lot better than that have old-fashioned loans, although there is good Virtual assistant financial support fee.

USDA money: USDA fund, developed by the newest Agency regarding Farming, need no down payment and will feel had which have a minimal credit history. They are only available when you look at the appointed outlying elements, regardless if.

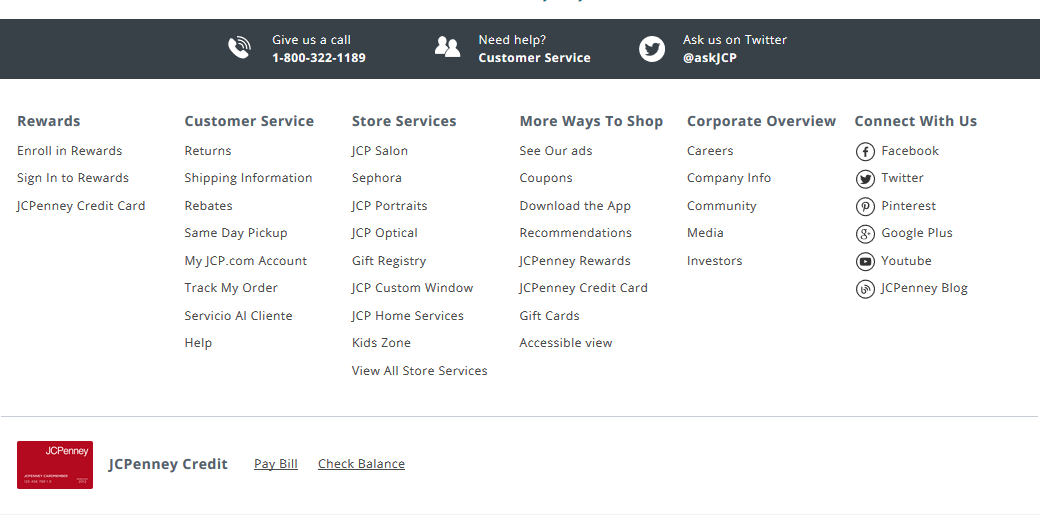

So what can You are doing On line Which have Portal Mortgage?

You can make an application for a loan online that have Gateway Financial, definition you will never have to take the issue of getting to your an office to meet up with which have a mortgage broker. It’s also possible to use Gateways web site to autopay your loan. This will make it simpler to definitely state to date on the costs.

Can you Be eligible for a mortgage away from Gateway Financial?

Portal will not give an explicit minimal FICO rating for its mortgages. However, typically, a credit rating of at least 620 will become necessary having a great antique mortgage, often repaired or changeable. Money that have bodies support have a diminished FICO get requisite. By way of example, an FHA financing might only need the very least credit rating off 580.

Having antique financing, a deposit with a minimum of 3% becomes necessary, regardless if this might change for the a customers-to-consumer foundation. If you’re able to muster upwards no less than 20% off, you simply will not you want individual financial insurance policies (PMI), that’s fundamental along the community.

What’s the Procedure to get a mortgage Having Portal Financial?

You can begin the method through getting preapproved for a financial loan using Portal Mortgage’s web site. You’ll be able to upload your related data files and you may Portal can find everything you qualify for.

Following that, you’ll want to pick a home. Once you’ve a property we want to purchase, you’ll bring your pre-recognition and also make a deal. The mortgage is certainly going to an enthusiastic underwriter having last approval. As soon as your mortgage is eligible, you’ll intimate the fresh new sale – and additionally using associated settlement costs – and then have their tips.

Just how Portal Mortgage Compares

You can aquire all of the mortgage choices you are looking for at Portal Home loan, plus preferred government-backed apps. If you’re in a condition where Gateway works, you may manage to find what you’re searching for.

Notably, Gateway has actually solid online systems, such as the capability to submit an application for a loan making financial costs on line. Many faster lenders don’t give which, thus that is a primary as well as towards company.