People that desire to acquire thanks to tough currency finance however need to meet the official certification put from the financial. These types of tend to range but usually were having sufficient earnings making payments on time. These lenders undertake greater risk fund, and this they need to have the ability to get rid of their threats in these credit points.

You’ll discover the greatest lenders study for many other claims for the our very own system. A primary-go out borrower try to shop for a tiny rental property regarding the Chicagoland urban area. Since the assets was not turnkey, they merely required white rehabilitation becoming lease-in a position. The fresh borrower try really-licensed but got troubles protecting a smaller sized loan from his local people lender.

Are you experiencing destroyed money in Illinois? Here’s how to check to own unclaimed possessions and you can money

This is a good solution when you casino 888 review have a bad credit score. After opting for a reputable difficult currency lenders Chicago, such as HardMoneyMan.com LLC, the next thing in the loan process would be to collect and you will prepare yourself the required documents. At the same time, you may need to render records to your one present liens otherwise mortgage loans on the property. It’s vital that you assemble most of these documents ahead and you may have them organized and able to yield to the financial institution. This helps streamline the borrowed funds process while increasing your chances out of approval. The price are $753,750 and the recovery finances are $400,one hundred thousand.

Private Money Lenders Difficult Money Money within the Chicago, IL

In the first place away from Nyc, Zac features spent their whole elite group community in the Fl with different opportunities inside the a property finance and brokerage, non-undertaking mention conversion process and you may loan origination. Zac try well equipped that have experience and knowledge across all facets of your Florida real estate market. During the Renovo, we’ll help you close easily and now have use of draws inside the 24 in order to 48 hours for your owning a home finance as the, inside a house, timing try everything. Renovo Financial is over a loan provider, we’re also your partner.

The Legal rights Set aside.Because of the entry an application to your all of our website you commit to found selling email correspondence out of EquityMax. EquityMax provides numerous consumers with many productive financing in our portfolio. EquityMax does not require our very own consumers as a corporation out of LLC. We are able to originate financing to prospects, LLCs, Companies, House Trusts, and you will Mind-Led IRAs.

State legislators oppose Chicago gran’s desire for more taxpayer bucks – Cardio Rectangular

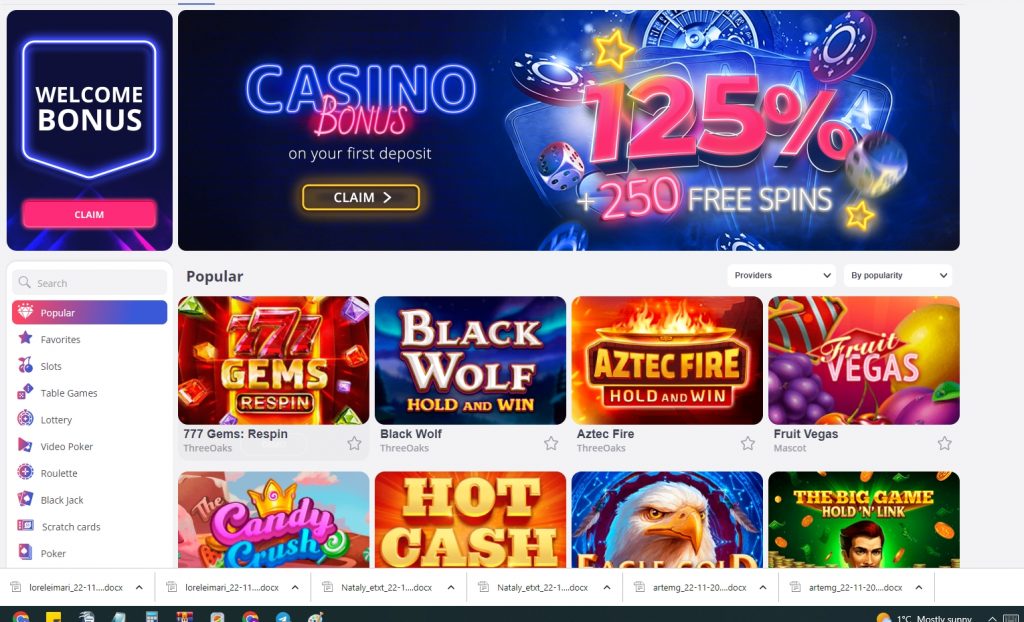

We talk about how to locate and you will play the better actual-currency online casinos, and ample acceptance bonuses and you can optimized cellular programs which might be inside the legalize online gambling jurisdictions. Call us right now to increase your home collection confidently. Chicago’s livability are a key grounds for real house investors. The fresh city’s vibrant social world, excellent public transit, and varied eating possibilities sign up to its desire. Concurrently, the brand new city’s dedication to system and you can societal features after that improves their livability. The current Chicago housing industry try watching increased sales, rising prices, and coming down directory.

S Colfax Ave Chicago IL 60617

These tough money money is a type of brief-label, high-attention financing created specifically to simply help those seeking quick access to help you fund for purchasing a financial investment property otherwise rehabbing one to currently owned. HardMoneyMan.com, LLC began lending for the money features to home people inside Chicago inside the 1998. All of our specific niche are step 1-4 tool qualities that will be needing restoration.

Federal Personal Lending’s Hard Currency Money inside the Chicago not one of them private earnings paperwork in order to meet the requirements and you may finance are designed beneath your organization’s term. Businesses are not essential to include people income files either, they are the newest otherwise experienced companies. Find out more about the Chicago difficult money software today, and put upwards a visit which have our benefits. Chicago Connection Finance & Chicago Long haul Money OptionsWe’re here to create your real estate industry!

Chicago’s market also provides profitable possibilities for develop and flip people. Of numerous older functions within the popular neighborhoods is actually best people for rehab and you will selling. Which portion of your field can also be produce extreme profits to have investors to your right knowledge and resources. Chicago, known for its diverse areas and you will rich history, could have been feeling steady people gains typically. The new city’s people gains are determined because of the points such work options, advanced schooling organizations, and you will social sites.

Personal currency credit will be the service you are looking for. Around 1979 Obama already been college or university at the Occidental within the Ca. He or she is most unlock in the their 2 yrs from the Occidental, he attempted all sorts of medications and you may try throwing away his day but, even though he’d an excellent notice, didn’t pertain himself in order to his knowledge. ‘Barry’ (which had been title the guy made use of all of the their lifetime) during this time had a couple roommates, Muhammad Hasan Chandoo and Wahid Hamid, each other of Pakistan. In summer from 1981, once their 2nd year inside school, the guy generated an excellent ’round the fresh world’ travel. Stopping observe his mom within the Indonesia, next Hyderabad within the India, three weeks inside Karachi, Pakistan where he lived together with his roommate’s family members, next out over Africa to see their dad’s family.

It permits the new borrower to get sufficient money to find the brand new household and enough financing and make fixes involved. It will help to pay for those individuals huge fixes otherwise home improvements one the house you’ll demand. When you’re interest levels are highest in these fund, borrowers have a tendency to make use of other features, for instance the lower down fee requirements. Even if loan providers put their own requirements, particular provide financing to those who have just 2% of the conversion process price of the property to place upon the acquisition.